Preventing Payroll Errors: Tips for Accurate Salary Calculations

Accurate salary calculations are crucial for maintaining employee trust and ensuring compliance with labor laws. Payroll errors, whether minor or significant, can lead to employee dissatisfaction, legal complications, and financial losses. Preventing these errors is essential for the smooth operation of any business. This article provides practical tips for accurate salary calculations, helping you avoid common pitfalls in payroll management.

1. Understand the Payroll Process

Know the Components: Payroll involves more than just calculating base salaries. It includes overtime, bonuses, deductions, taxes, and benefits. Understanding each component and how it fits into the overall process is the first step in ensuring accuracy. Make sure you’re familiar with how to calculate gross pay, net pay, and various deductions.

Stay Informed About Regulations: Payroll regulations, including tax laws and labor standards, can change frequently. It’s vital to stay updated on federal, state, and local regulations that affect payroll. This will help you ensure that your payroll calculations comply with the latest legal requirements.

2. Use Reliable Payroll Software

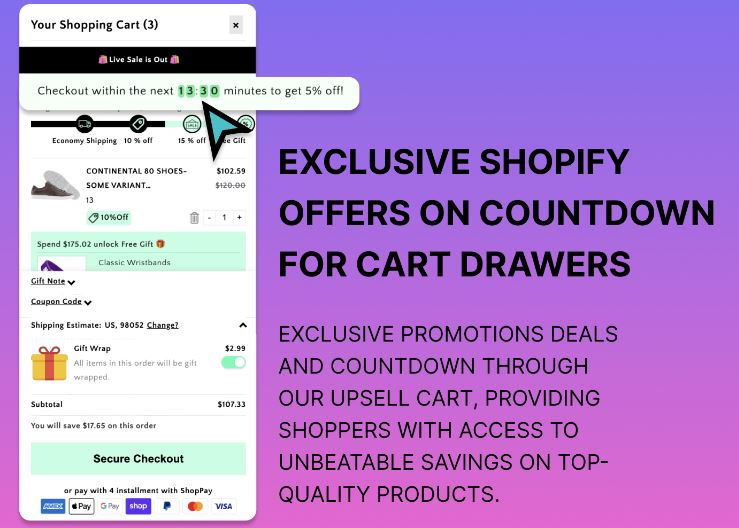

Automate Calculations: Manual calculations are prone to errors, especially when dealing with complex payroll scenarios. Using reliable payroll software can automate calculations, reducing the risk of mistakes. The software can also keep track of overtime, deductions, and other variables that impact salary calculations.

Regularly Update Software: Ensure that your payroll software is regularly updated to incorporate changes in tax rates, regulations, and other factors that influence payroll. This will help you avoid errors related to outdated information.

3. Double-Check Data Entry

Accurate Employee Information: One of the most common sources of payroll errors is incorrect employee information. Ensure that all employee details, such as tax withholding preferences, salary rates, and benefit selections, are entered correctly. Regularly review and update this information to prevent errors.

Cross-Verify Entries: Even with automated systems, it’s important to cross-verify entries to catch any discrepancies. A second set of eyes or a routine audit can help identify and correct errors before they affect payroll.

4. Monitor Year-to-Date Totals

Track Year-to-Date (YTD) Information: Monitoring year-to-date information is crucial for accurate payroll management. YTD figures reflect the total amount an employee has earned from the beginning of the year up to the current payroll period, including all deductions and contributions. Understanding what does year to date mean on a pay stub helps you ensure that these figures are accurate, which is essential for tax reporting and compliance.

Adjust for Corrections: If there are any payroll corrections or adjustments, make sure they are accurately reflected in the YTD totals. This ensures that employees receive correct end-of-year tax documents and that your records are accurate.

5. Conduct Regular Payroll Audits

Internal Audits: Regular internal audits of your payroll process can help identify and rectify any discrepancies before they escalate. An audit should include a review of payroll calculations, employee records, tax filings, and any other relevant documentation.

External Audits: Consider having an external audit performed periodically. An independent review can provide an objective assessment of your payroll accuracy and highlight areas for improvement.

6. Communicate with Employees

Provide Clear Pay Stubs: Ensure that pay stubs are clear, detailed, and easy to understand. Employees should be able to see how their salary was calculated, including gross pay, deductions, and net pay. Clear communication can prevent misunderstandings and disputes.

Encourage Employee Feedback: Encourage employees to review their pay stubs and report any discrepancies or concerns promptly. This proactive approach can help catch and correct errors quickly, ensuring that employees are paid accurately.

Conclusion

Preventing payroll errors is essential for maintaining employee trust, avoiding legal issues, and ensuring the financial health of your business. By understanding the payroll process, using reliable software, double-checking data entries, monitoring year-to-date totals, conducting regular audits, and maintaining open communication with employees, you can significantly reduce the risk of payroll errors.

Incorporating these best practices into your payroll management process will help you achieve accurate salary calculations and create a more efficient, error-free payroll system.