How to Obtain and Strategically Sell Tax Lien Certificates: Effective Strategies for 2024

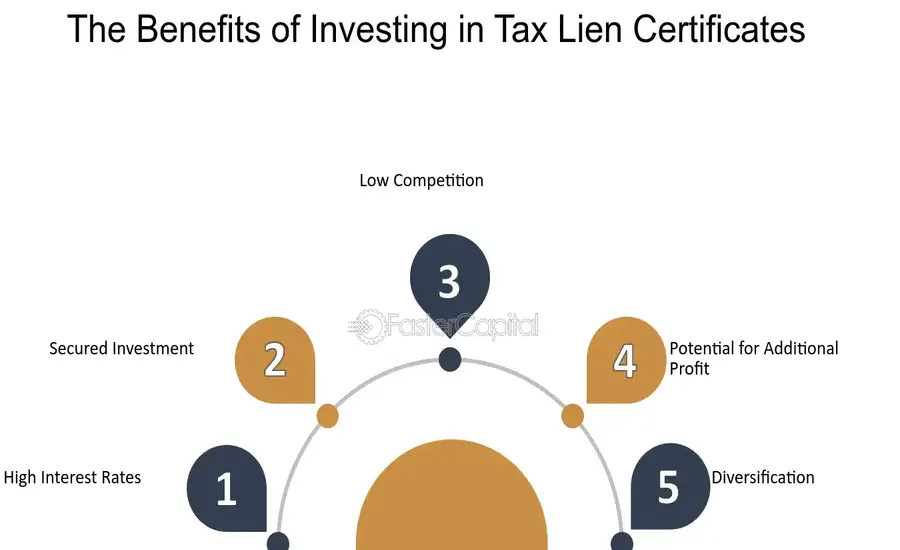

Tax lien investing is a powerful tool for diversifying your investment portfolio. This guest post will guide you through obtaining tax lien certificates and provide effective strategies for maximizing your returns. We’ll also discuss the optimal timing for selling these certificates to ensure you get the best possible outcome.

What are Tax Lien Certificates

Tax lien certificates are issued by the government when a property owner fails to pay their taxes. By purchasing these property tax lien certificates, investors pay the owed taxes on behalf of the property owner, gaining the right to collect interest on the debt. If the property owner fails to repay the debt within a specified period, the investor may acquire ownership of the property.

Steps to Obtain a Tax Lien Certificate

Research and Preparation

Local Laws and Regulations

Start by understanding the tax lien laws in your target area. Each state regulates interest rates, redemption periods, and bidding processes.

Market Research

Investigate the local real estate market to identify areas with high demand and potential for property appreciation.

Budgeting

Determine how much you are willing to invest and set a budget. Remember to account for additional costs, such as legal fees and property maintenance, if you end up acquiring the property.

Finding Tax Lien Sales

County Websites

Many counties list tax lien sales on their official websites. These listings provide details about upcoming auctions, properties available, and bidding procedures.

Online Auctions

Some jurisdictions hold online tax lien auctions, making it easier to participate without being physically present.

Networking

Connect with other investors, real estate agents, and local officials who can provide insights into upcoming tax lien sales and valuable properties.

Participating in Auctions

Registration

Register for the auction in advance. This often requires providing identification and proof of funds.

Due Diligence

Before bidding, perform thorough due diligence on the properties. This includes checking for any additional liens, assessing the property’s condition, and estimating its market value.

Bidding Strategies

Develop a bidding strategy that aligns with your budget and investment goals. Consider starting with smaller bids to gain experience before moving on to higher-value properties.

Effective Strategies for Managing Tax Lien Investments

Diversification

Spread your investments across different properties and regions to reduce risk. Diversification ensures that a single failed investment won’t significantly impact your overall portfolio.

Investment Types

Consider diversifying not just geographically, but also by types of properties (e.g., residential, commercial, vacant land).

Staggered Investments

Spread your investments over different time periods to balance short-term gains with long-term stability.

Risk Management

Evaluate the risk associated with each tax lien certificate. Properties in economically stable areas with high demand and lower delinquency rates are generally safer investments.

Insurance

Consider purchasing insurance to protect your investments against unexpected legal or property issues.

Exit Strategies

Plan multiple exit strategies for each investment. This could include selling the lien, foreclosing on the property, or waiting for market conditions to improve.

Monitoring and Follow-Up

Regularly monitor the status of your tax lien certificates. Stay informed about the redemption period and any payments made by the property owner. Promptly address any issues that arise, such as unpaid taxes or legal challenges.

Automated Alerts

Set up automated alerts to notify you of any changes in the status of your liens or important deadlines.

Professional Assistance

Hire a property management or legal professional to help manage your investments and ensure all legal requirements are met.

When to Sell Your Tax Lien Certificates

Redemption Period Expiry

Once the redemption period expires, you can decide whether to foreclose on the property or sell the tax lien certificate. If the property is valuable and in good condition, foreclosing may yield higher returns. If not, selling the certificate can be a quick way to recover your investment and earn interest.

Market Conditions

Monitor the real estate market to identify favorable conditions for selling your tax lien certificates. Selling during a market upswing can maximize your returns.

Financial Goals

Align your selling strategy with your financial goals. Selling the certificates earlier may be beneficial if you need liquidity. If you aim for long-term gains, holding onto the certificates until property values increase can be more profitable.

The Bottom line

Obtaining and managing property tax lien certificates can be a lucrative investment strategy when done correctly. By conducting thorough research, diversifying your investments, and staying informed about market conditions, you can maximize your returns. Knowing when to sell your tax lien certificates is crucial to achieving your financial goals. With the right strategies, tax lien investing can be a valuable addition to your investment portfolio.

Tax Lien Code offers expert guidance on tax lien investing, providing investors with actionable strategies and insights. By focusing on comprehensive market analysis and risk management, it helps clients secure profitable tax lien certificates. With a commitment to education and informed decision-making, Tax Lien Code empowers investors to achieve substantial returns and navigate the complexities of the tax lien market.